Credentials & Experience

I'm federally credentialed as an Enrolled Agent and have advised on upwards of multi-million dollar transactions for hundreds of taxpayers in the last 6 years, navigating through a number of niche tax issues.

Tax Strategy & Planning

Tax Preparation

Audit Representation

Tax Policy

Tax Education

retroactive refund for a low-income student & parents, missed by tax pro and FreeTaxUSA

retroactive refund for an American expat, missed by TurboTax

tax savings for an international student, missed by TurboTax

penalties waived for an immigrant family

tax savings for a student, caused by a mistake on TurboTax

penalties avoided by filing obscure form immigrant student was unaware of

tax savings for an immigrant on work income by using carefully crafted tax position

Your tax savings might join this hall of fame.

I'm federally credentialed as an Enrolled Agent and have advised on upwards of multi-million dollar transactions for hundreds of taxpayers in the last 6 years, navigating through a number of niche tax issues.

Previously, I founded and led TaxFellows, a VITA tax clinic that partnered with the IRS and various Stanford offices that served students and low-income taxpayers.

Under my leadership, I had scaled the clinic to a team of 16 volunteers and 350+ annual clients in two years, achieved the lowest e-file rejection rate across all new VITA clinics on the West Coast by implementing strong quality control measures, and secured federal funding as one of two organizations in the entire San Francisco Bay Area.

I'm a member of the National Association of Enrolled Agents (NAEA), where I serve as a board member on its political action committee (PAC), lobbying for better service levels for the IRS and minimum standards for practice to protect consumers.

I was confirmed by U.S. Treasury in 2024 to serve a 3-year term on the Electronic Tax Administration Advisory Committee (ETAAC) in Washington, D.C., where I currently serve as the tax professionals subcommittee chair, to advise the IRS and Congress on improving the tax system using technology.

I'm an immigrant who grew up in a low-income, single parent household. I'm also a seasoned, Stanford-educated software engineer, a former startup founder, and a business owner. These experiences have enabled me to deliver highly personalized, practical advice to clients from all walks of life.

We will always fight for the best result for you by using extensive research to craft clever yet defensible positions. However, we will also be frank with you when we've hit the ceiling for your tax optimizations.

We strive to provide the best-in-class experience for you in part by using tech in new and innovative ways. At the same time, you can trust that you will always be working with a human on your taxes, and we will never use your data to train AI models.

We recognize how sensitive your personal and financial data is. We also recognize the limited jurisdiction the U.S. has against data thieves abroad. That's why our team will always be 100% U.S.-based, and your data will always remain in the U.S.

We don't have investors, which allows us to focus on just fighting for our clients and doing things the right way. We are building a generational firm that clients have come to rely on for life.

20% off for tax prep clients

$250/yr min. for non-clients

Audit representation, late filings, delinquent tax debts, etc.

+$25 per account after four

Analysis fee (optional): $125/ea

Federal & 1 State Included

Federal & 1 State Included

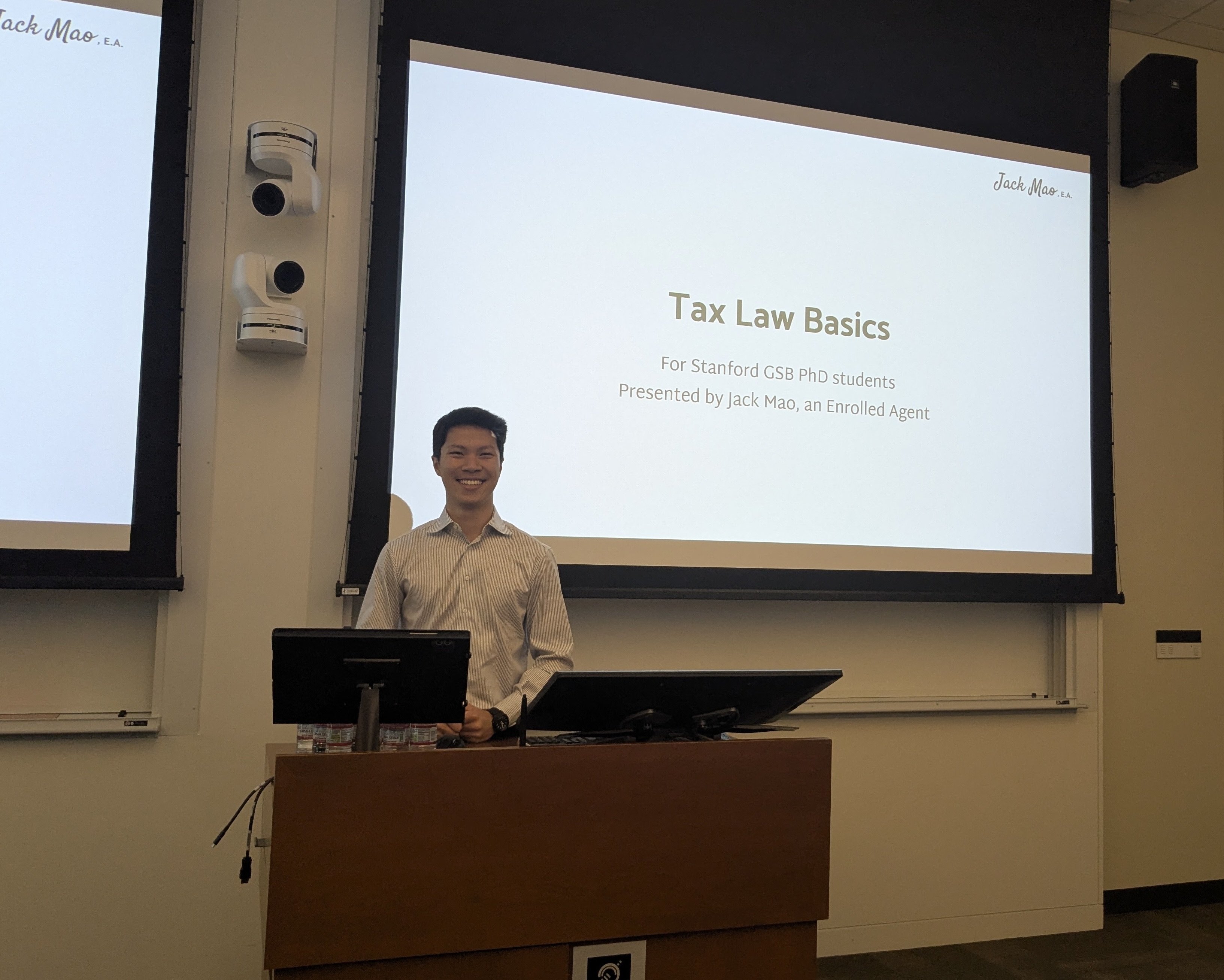

Jack regularly works with U.S. college partners to provide crucial tax education and support to college students as they navigate through the nuanced and complex U.S. tax system for the first time in their lives.

Current and past partners include: Stanford Mind Over Money, Stanford Bechtel International Center, Stanford First-Generation and/or Low-Income Student Success Center, Stanford Graduate School of Business, Stanford King Center on Global Development, and Stanford Graduate Life Office.

Annually, Jack also trains tax clinic volunteers on tax law from the ground up at his VITA tax clinic, TaxFellows, to help volunteers new to tax feel confident in preparing tax returns for low-income families and individuals.

Tax workshops hosted

Tax clinic volunteers trained